FTX (Blockfolio)

FTX (formerly known as BlockFolio), a well-known crypto currency portfolio management, has released an interest service called FTX Earn in summer 2021.

Since it is operated by a major FTX, I believe that its creditworthiness is higher than that of other lending companies.

I also have been using FTX Earn since its service launch.

I would like to describe the advantages and disadvantages from the viewpoint of my actual use of the FTX Earn interest service.

Overview of Blockfolio

BlockFolio is a crypto currency portfolio management app created by Peter Lau in 2014.

The app was created in 2014, the year Mt Gox happened and in the early days when crypto currencies were not yet common.

Today, there are many crypto currency portfolio apps such as CoinmarketCap and Coingecko, but BlockFolio was the first crypto currency portfolio app to be released in 2014.

In 2020, FTX, a major crypto currency exchange, acquired BlockFolio for $150 million.

After the FTX acquisition, the app was renamed from BlockFolio to FTX, and many services were released, including trading and interest services.

Today, FTX offers much more than just a portfolio management tool.

SBF (Sam Bankman Fried), CEO of FTX, said at the time of the BlockFolio acquisition that he acquired the company for the synergy with FTX.

And as of 2022, FTX (BlockFolio) is an app with over 6 million users and is used in over 200 countries.

The acquisition price of $150 million was quite large for a mobile app acquisition, but the name of the app was changed to FTX, and I think it was a meaningful acquisition because it contributed greatly to raising FTX's name recognition.

Overview of Blockfolio

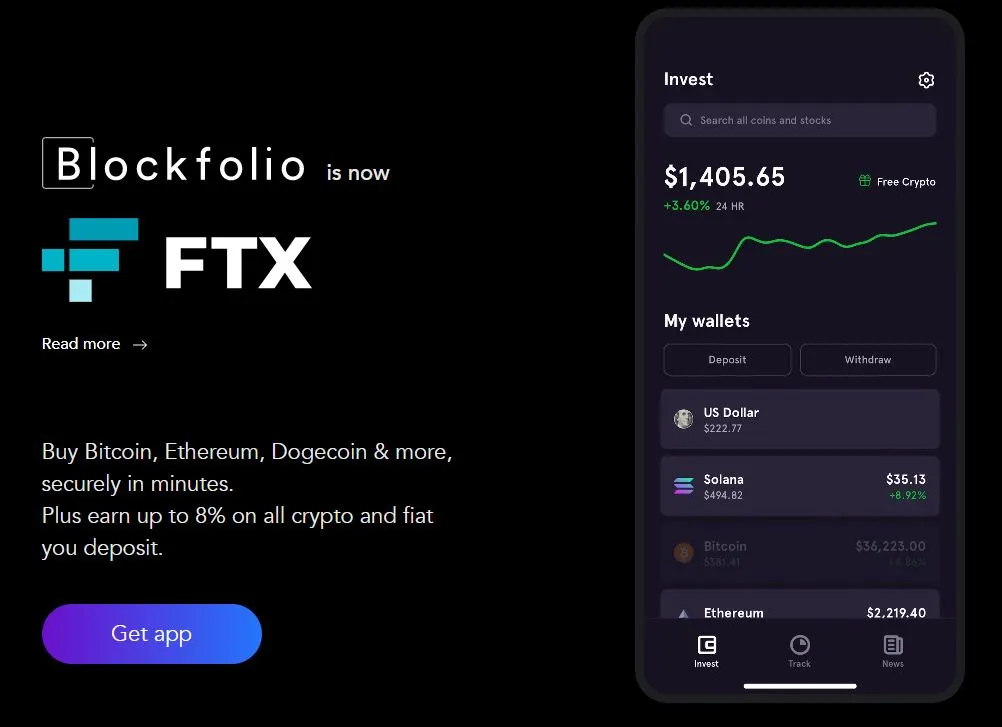

Blockfolio offers a service that is available only as an app for iOS and Android phones.

It is not available on the web. So you need to have a cell phone.

BlockFolio's three main services are as follows

- Portfolio function(asset value tracking)

- FTX Earn (BlockFolio Earn)

- Trade Function

Portfolio function (asset value tracking)

BlockFolio's most popular service is the portfolio function.

BlockFolio is the leading tool for checking crypto currency prices, and many people who invest in crypto currencies use it.

With Blockfolio, you can centrally manage the quantity of crypto currencies you have invested, the exchanges, and the prices at which you purchased them.

It supports many crypto currencies, from major to minor.

You can also add news settings and price change alerts for the crypto currencies you are interested in, allowing you to check the market status in real time.

Since the prices are updated in real time and there is no need to open a chart on an exchange, the app is so addictive that you may open BlockFolio several times a day to check the prices.

In addition, there are no fees to use the app. It is free.

I personally think it is such a great service that it could be paid for.

BlockFolio Portfolio Features

Excellent UI and UX

I personally believe that the reason why BlockFolio has gained 6 million users is because of its excellent UI and UX.

It is a very easy-to-use application.

In fact, competitors Coingecho, CryptoFolio, and CoinmarketCap have more coins handled and more features than BlockFolio, but they are not as easy to use compared to BlockFolio.

All apps can manage multiple portfolios divided by assets, but BlockFolio can be easily viewed with a single click.

The other apps require several clicks, which is time-consuming and not easy to use.

I think the best feature of BlockFolio's portfolio app is that it is not only the first one created in 2014, but also has a great UI and UX!

Local and minor coins are not supported.

Disadvantage of Blockfolio is that local coins are often not supported.

For example, Zaif tokens and Comsa from Japanese exchanges,KUB,ZMT,BTZ from Thai exchange are not available.

Requests for new coins are always accepted, but minor currencies are not managed with specifications that are added based on the number of applications.

The large number of unsupported coins is an inferior point compared to CoinmarketCap and CoinGecho.

This is a major disadvantage for those who have many local coins that are not available on BlockFolio.

I myself use CoinGecho and CoinMarketCap in conjunction with BlockFolio due to the fact that I have many local coins that cannot be managed by BlockFolio.

The fact that many coins are not handled is a major disadvantage, but BlockFolio is even easier to use than those coins, so I use BlockFolio as my main service.

FTX Earn (BlockFolio Earn) interest rate service

Next, I describe the interest earning service at BlockFolio.

This service is the newest service in BlockFolio, having started in the summer of 2021.

This will be the main message of this article.

There are two ways to use FTX Earn

Basic Verification without KYC

- Deposits: limited to $5,000 for 10 days, each deposit is limited to $2,999

- Withdrawals: No restriction on crypto withdrawals (not stated in FAQ)

Full Verification with KYC

- Deposits: limited to $30,000 for 10 days, each deposit up to $20,000

- Withdrawals: No restrictions on crypto withdrawals (not stated in FAQ)

You can use FTX Earn without KYC, but it is recommended that you perform KYC to use the service, as it is safer to have proof of identity in case something goes wrong.

Next, I would like to introduce what I have found to be the advantages of FTX Earn over other lending companies.

What makes FTX Earn better than other lending companies

There are four things that I feel make FTX Earn superior to other lending services

What makes FTX Earn better than other lending companies

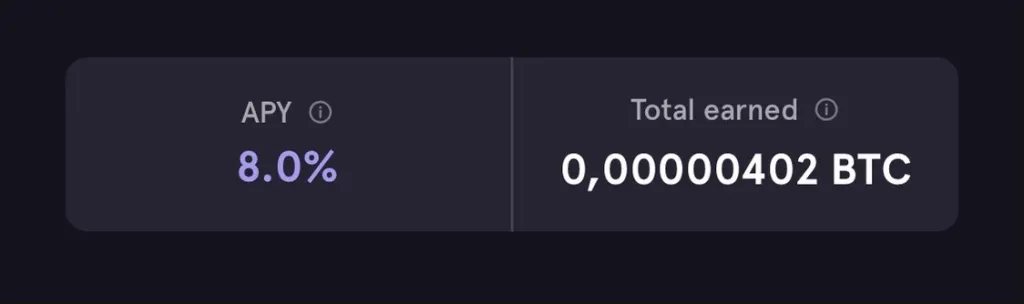

FTX Earn offers a flat 8% regardless of the type of crypto currency.

No other lending company offers this type of APY.

If you deposit BTC or ETH with FTX Earn, you can operate at an industry-leading 8% APY.

The 8% APY is only available up to $10000 and will be reduced from 8% if you deposit more than $10000.

- Example 1. 8% APY if you deposit $10000 worth of crypto currency

- Example 2. If $15,000 worth of crypto currency is deposited, 8% APY is applied to the first $10,000, and 5% APY is applied to the remaining $5,000 worth of crypto currency, resulting in an APY of 6.5% for the total $15,000 deposit.

With FTX Earn, BTC and ETH within $10,000 can operate at 8%.

I prepare multiple accounts and diversifies them to operate as close to 8% as possible to get as high an APY as possible.

Note that assets deposited in an interest account can be withdrawn at any time, so there is no need to lock them.

The largest number of crypto currencies supported by interest services in the lending industry

FTX Earn supports the largest variety of crypto currencies in the lending services industry.

I tried to excerpt the coins I support, but there are too many to list. That's how many coins are supported.

The number of supported crypto currencies is more than Crypto.com, the largest in the industry.

Coins that would never be supported elsewhere are also supported by FTX Earn, so for those who hodl minor currencies, earning interest is a very good response.

In addition to crypto currencies, FTX Earn also supports legal tender, and it is possible to earn interest in legal tender as well.

The legal tender currencies supported are as follows.

- USD (US Dollar)

- EUR (Euro)

- GBP (British Pound)

- CAD (Canadian dollar)

- CHF (Swiss Franc)

- HKD (Hong Kong dollar)

- SGD (Singapore dollar)

- ZAR (South African Rand)

Multi-chain support including BSC and SOL in remittance network

FTX Earn supports multiple chains.

For example, the following chains can be selected for the following crypto currencies

- Bitcoin: BTC,BSC,SOL

- Ethereum: ETH,BSC,SOL

- USDC: ETH,BSC,SOL

Lending companies basically only support single chain.

Both industry giants BlockFi and Nexo only use the ETH network for ETH and stablecoins; ETH network usage fees (gas costs) are ridiculous.

The multi-chain support is a very welcome addition to the lending experience.

The only other lenders with multi-chain support are Crypto.com and Youhodler. Crypto.com offers multi-chain support for FTX Earn and above, while Youhodler offers only BSC support.

Supported by the world's top company, FTX

I think the best thing about FTX Earn is that the company supporting it is FTX.

There are many things to consider when using a lending service.

- Is the company credible?

- Do they have good security measures?

- Is the company well funded?

- Do they have many users?

No matter which lending company you use, you could be hacked and risk losing all of your funds.

It is very important to be selective about which lending company you use.

FTX Earn is supported by FTX, the top exchange in the crypto currency industry, and has excellent credibility.

The company's security measures, including anti-hacking measures, are flawless, and its financial strength is higher than that of other lending companies.

In my opinion, being supported by FTX is the best feature of FTX Earn.

Compared to other lending companies, I consider it the safest place to entrust my funds.

The latest Interest Rates are listed on the following page in comparison with other competing companies

Interest rates interest ratesTrade Function

BlockFolio also implements a trade function on the application.

Basically, the functionality is the same as a sales office, and trades on the lending company should be avoided because they are settled at a higher price than trades on an exchange.

However, as far as I could tell, the invisible sales commission was less expensive than other lending companies.

They settle at a rate that is totally better than the selling price of other companies.

It is of course inferior to trading on an exchange, but it offers a much better rate when compared to other lending companies.

I think the low sales commissions are due to the fact that they are supported by FTX, which has the world's top trading volume.

Another interesting point compared to the trading features of other lending companies is that they offer the privilege of receiving a randomly selected crypto currency for each trade.

FTX(Blockfolio) Customer Support

You can contact FTX support on the BlockFolio application.

There are also plenty of FAQs available, so if you have any questions, you can use the FAQs to find out what is going on.

Since there are 6 million users, it is assumed that the response time is often not that fast, but when I inquired, I received a response within a few days.

I don't think a response in a few days is that fast. Other lending companies may respond immediately, so I would have to say that it is slow compared to other lending companies.

I personally think that BlockFolio's customer support is not that fast.

Binance and Crypto.com, which have over 6 million customers, have a much faster response time.

FTX(BlockFolio) Customer support responsiveness may be a disadvantage.

2022 FTX(Blockfolio) Review

I describe the advantages, disadvantages and summary from my point of view

Pros and Cons

Pros

- The industry's largest variety of crypto currencies available for interest services

- Industry-leading 8% APY for BTC and ETH within $10,000

- Supported by FTX with high financial strength and creditworthiness

- Multi-chain support and extremely low transfer fees for both deposits and withdrawals

Cons

- Cannot be managed on the web (mobile only)

- Slow response time from FTX(Blockfolio) customer support

Summary

The best feature and benefit of FTX Earn is still that it is supported by FTX, one of the top exchanges in the industry.

Even if you have never used an interest service before, the fact that it is supported by FTX makes this platform a safe choice.

FTX Earn's interest rates are not high compared to other lending companies, but depending on how you invest your money, which can be as low as $10,000, you can earn a high APY.

I would say that this service is recommended even for intermediate level borrowers.

This service can be recommended for a wide range of investors, including those who want to earn interest while using Hodl, those who are new to Hodl, and those who want to manage their investments in a diversified manner.